Managing insurance claims can feel like navigating a maze. Whether you're an employer, insurance provider, or healthcare organization, the complexity of processing claims demands expertise, precision, and efficiency. This is where professional claims administration services become invaluable. In this comprehensive guide, we'll explore everything you need to know about claims administration, from understanding the basics to selecting the right service provider for your organization.

Understanding Claims Administration Services and Their Critical Role

Claims administration services represent the backbone of insurance operations, encompassing the entire lifecycle of a claim from initial submission to final payment. These services handle the detailed work of receiving, reviewing, processing, and resolving insurance claims while ensuring compliance with regulatory requirements and policy terms. When organizations partner with specialized administrators, they gain access to expertise that transforms what could be a cumbersome process into a streamlined operation.

The scope of these services extends far beyond simple paperwork processing. Professional administrators evaluate claim validity, verify coverage details, coordinate with healthcare providers, communicate with claimants, and ensure accurate payment disbursement. They also maintain detailed records, generate reports, and provide analytics that help organizations make informed decisions about their insurance programs.

What makes professional claims administration particularly valuable is the combination of human expertise and technological capability. Modern administrators leverage sophisticated software systems that can flag inconsistencies, detect potential fraud, and expedite routine claims while experienced professionals handle complex cases requiring nuanced judgment. This blend creates an environment where accuracy meets efficiency, reducing errors and processing times significantly.

The Essential Components of Professional Claims Administration

Every effective claims administration system rests on several fundamental pillars that work together to create seamless operations. The first component is intake management, where claims are received through various channels—electronic submissions, mail, phone calls, or online portals. This initial stage requires careful attention to ensure all necessary documentation is collected upfront, preventing delays caused by missing information.

Once received, claims enter the adjudication phase, where administrators review the submission against policy terms and coverage limits. This involves verifying the claimant's eligibility, confirming the service or event is covered, and calculating the appropriate benefit amount. Adjudication requires deep knowledge of insurance regulations, policy language, and industry standards to ensure consistent and fair decision-making.

Payment processing forms another critical component, involving the actual disbursement of approved claim amounts. This stage demands rigorous financial controls, accurate record-keeping, and timely execution to maintain claimant satisfaction. Modern systems often integrate directly with banking infrastructure to facilitate electronic payments, reducing processing time from weeks to days. Throughout all these stages, communication management ensures that claimants, providers, and stakeholders receive timely updates about claim status, required actions, or decision rationales.

How Claims Administration Services Transform Healthcare Operations

In the healthcare sector, claims administration takes on additional complexity due to the intricate web of providers, payers, patients, and regulatory bodies. Healthcare claims must navigate coding requirements, medical necessity determinations, coordination of benefits, and complex billing structures that vary by procedure, location, and contract terms. Professional administrators bring specialized knowledge that ensures claims are processed according to the specific requirements of medical insurance.

The transformation begins with reduced administrative burden on healthcare providers. When physicians and hospitals can submit claims to competent administrators who understand medical terminology, procedure codes, and documentation requirements, they spend less time on follow-up and resubmissions. This efficiency allows healthcare organizations to focus on patient care rather than billing disputes and paperwork.

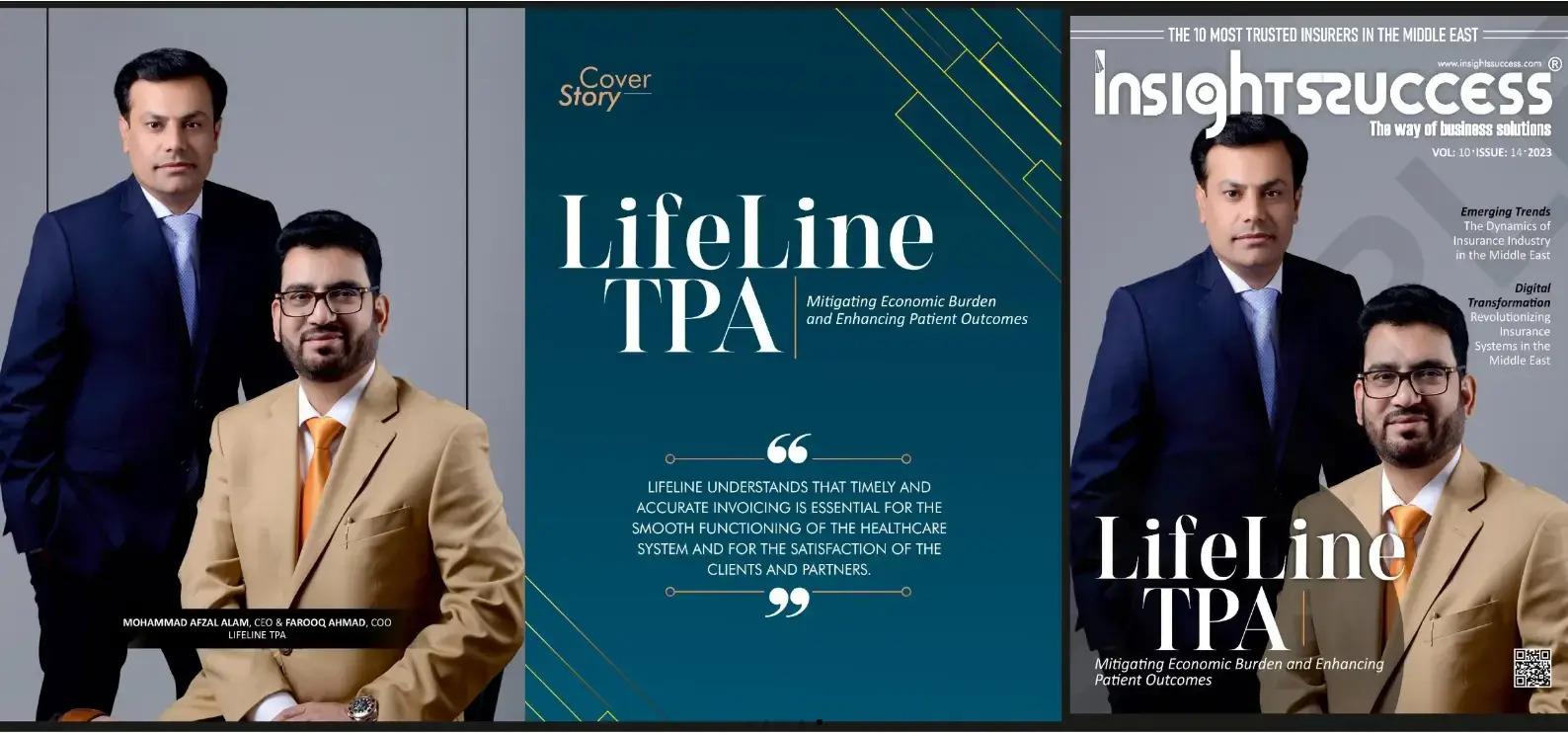

For employers offering health benefits, Lifeline TPA and similar third-party administrators provide comprehensive solutions that handle everything from plan design support to employee communication. These services ensure that workers receive prompt claim resolution, which directly impacts satisfaction with their benefits package. When claims are handled efficiently, employees feel valued and supported, which can improve retention and workplace morale.

Cost containment represents another significant advantage. Professional administrators implement controls that prevent overpayment while ensuring legitimate claims are paid accurately. They identify billing errors, duplicate claims, and services that may not be covered under the policy terms. This vigilance protects the financial integrity of benefit plans without creating unnecessary barriers to care.

Key Technologies Driving Modern Claims Administration

Technology has revolutionized claims administration, introducing capabilities that were unimaginable just a decade ago. Artificial intelligence and machine learning algorithms now assist in claim evaluation, identifying patterns that might indicate fraud or error while expediting straightforward claims that meet all standard criteria. These systems learn continuously, becoming more accurate and efficient with each claim they process.

Cloud-based platforms have eliminated geographical constraints, allowing administrators to manage claims from anywhere while providing real-time access to claim data for authorized users. This accessibility improves transparency and enables faster collaboration between administrators, providers, and claimants. Stakeholders can check claim status, upload documents, or communicate with administrators through secure portals without playing phone tag or waiting for mail correspondence.

Data analytics tools transform raw claim information into actionable insights. Organizations can identify trends in claim types, costs, and processing times, allowing them to make strategic decisions about plan design, vendor negotiations, or process improvements. Predictive analytics can even forecast future claim volumes and costs, supporting better financial planning and reserve management.

Automation handles repetitive tasks that once consumed countless administrative hours. From initial data entry to status notifications and payment processing, automated workflows reduce human error while freeing staff to focus on complex cases requiring personal attention. This technology doesn't replace human judgment but amplifies it, allowing administrators to handle higher volumes without sacrificing quality.

Benefits That Extend Beyond Basic Claims Processing

Professional claims administration delivers advantages that ripple throughout an organization, extending well beyond the immediate task of processing individual claims. One often-overlooked benefit is risk management. Experienced administrators identify patterns and issues that might indicate larger problems, from provider billing practices that warrant attention to injury trends that suggest workplace safety concerns. This intelligence allows organizations to address root causes rather than simply managing symptoms.

Compliance assurance provides another layer of value in an increasingly regulated environment. Lifeline insurance and other professional administrators stay current with changing regulations, ensuring that claim handling practices meet legal requirements across all applicable jurisdictions. This vigilance protects organizations from penalties, legal challenges, and reputation damage that can result from non-compliance.

Enhanced customer experience directly influences how claimants perceive the entire insurance program. When claims are processed quickly, accurately, and with clear communication, satisfaction increases even when claim decisions aren't entirely favorable. Positive claims experiences strengthen relationships between employers and employees, insurers and policyholders, or providers and patients.

Financial predictability improves when professional administrators implement consistent processes and controls. Organizations gain better visibility into claim costs, can forecast expenses more accurately, and identify opportunities to optimize their insurance programs. This financial intelligence supports strategic planning and budgeting across the organization.

Selecting the Right Claims Administration Partner

Choosing a claims administration service provider ranks among the most important decisions an organization can make regarding its insurance operations. The right partner brings expertise, technology, and service quality that can significantly impact operational efficiency and stakeholder satisfaction. Several factors should guide this selection process.

Experience and specialization matter enormously. Providers with deep experience in your specific industry or claim type will understand the nuances that affect processing. A provider specializing in workers' compensation claims will have different expertise than one focused on health insurance or disability claims. Review their track record, client testimonials, and case studies to assess their capability in your area of need.

Technology infrastructure deserves careful evaluation. Ask potential partners about their systems, security measures, integration capabilities, and disaster recovery plans. The best technology should be both powerful and user-friendly, providing sophisticated functionality without requiring extensive training. Consider whether they offer the reporting and analytics capabilities you need to manage your program effectively.

Service level agreements establish clear expectations about processing times, accuracy rates, and communication standards. Review these carefully and ensure they align with your organizational requirements. Understand how the provider handles disputes, appeals, and complex cases. The best administrators maintain high approval rates while protecting against inappropriate claims, striking a balance that requires skill and judgment.

Getting Started with Claims Administration Services

Implementing professional claims administration services requires thoughtful planning to ensure a smooth transition and maximize value. The process typically begins with a comprehensive assessment of your current situation, including claim volumes, complexity, existing systems, and pain points. This assessment helps identify specific requirements and priorities that will guide provider selection and implementation planning.

During implementation, clear communication becomes paramount. All stakeholders—from employees filing claims to finance teams managing payments—need to understand how the new system works, what changes to expect, and where to find help if needed. Providing Life Line toll free number and other contact resources ensures that everyone can access support when needed, reducing confusion and maintaining continuity during the transition.

Training plays a crucial role in successful adoption. Anyone who will interact with the claims administration system needs appropriate training on processes, systems, and expectations. This might include human resources staff, benefits coordinators, or managers who handle workers' compensation claims. Comprehensive training reduces errors, builds confidence, and accelerates the realization of benefits from the new system.

Ongoing monitoring and optimization should continue well after initial implementation. Regular reviews of key performance indicators, stakeholder feedback, and claim outcomes help identify areas for improvement. The best relationships between organizations and their claims administration partners are collaborative, with both parties working together to continually enhance processes and results.

Conclusion: Investing in Excellence

Claims administration services represent much more than operational outsourcing—they're strategic partnerships that can transform how organizations manage risk, serve stakeholders, and control costs. In an environment where healthcare expenses continue rising, regulatory requirements grow more complex, and stakeholder expectations increase, professional claims administration has become essential rather than optional.

The best claims administration services combine technological sophistication with human expertise, creating systems that handle routine matters efficiently while applying seasoned judgment to complex situations. They provide transparency through reporting and analytics, compliance through vigilant adherence to regulations, and satisfaction through responsive service.

Whether you're exploring claims administration services for the first time or considering a change from your current provider, the investment in quality administration pays dividends through improved accuracy, faster processing, better compliance, and enhanced satisfaction among all stakeholders. As you move forward, prioritize partners who demonstrate expertise in your specific needs, invest in technology that supports efficiency without sacrificing service quality, and commit to the collaborative relationship that drives continuous improvement. With the right partner, claims administration transforms from a necessary burden into a strategic advantage that supports your broader organizational objectives.